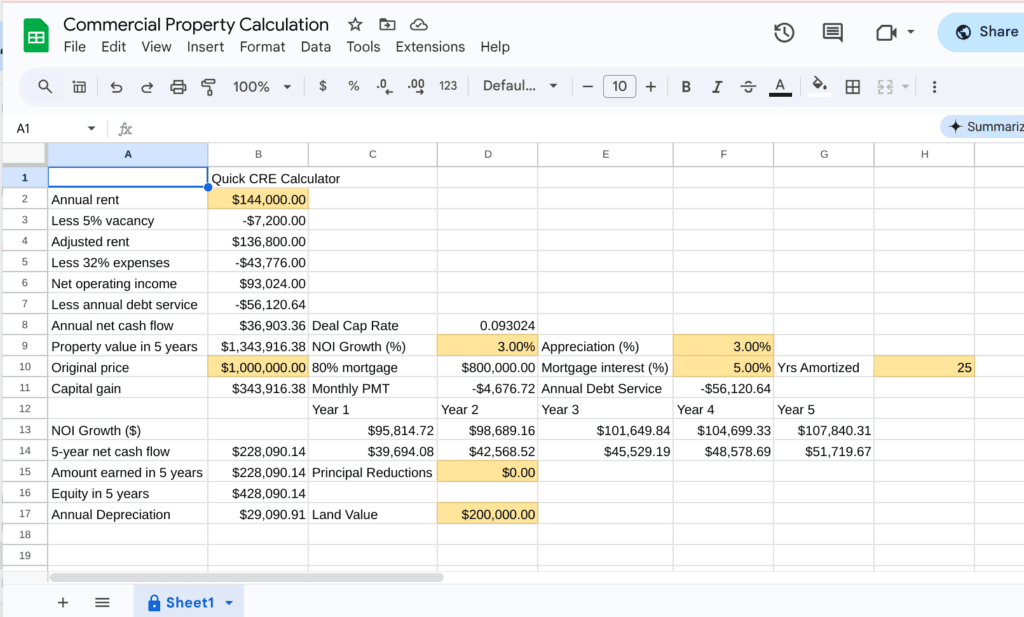

tldr: Ever wanted to know quickly if a deal will pencil out? See my spreadsheet to start.

Real estate investing can be incredibly rewarding, but it’s also a significant financial undertaking. Before diving headfirst into your next Commercial Real Estate (CRE) purchase, it’s absolutely crucial to run the numbers. This involves a thorough financial analysis to assess the potential risks and rewards of the investment.

Here’s a breakdown of key factors to consider:

1. Determine the Purchase Price:

- Accurate Appraisal: Obtain a professional appraisal to determine the property’s fair market value.

- Negotiate Strategically: Leverage the appraisal and market data to negotiate a favorable purchase price.

2. Project Income and Expenses:

- Estimate Potential Rent: Research comparable properties in the area to determine realistic rental rates.

- Forecast Occupancy Rates: Account for potential vacancies and seasonality.

- Project Operating Expenses: Estimate expenses such as property taxes, insurance, maintenance, utilities, and property management fees.

- Create a Pro Forma: Develop a detailed pro forma statement that projects income and expenses over a specific period (e.g., 5-10 years).

3. Calculate Key Financial Metrics:

- Net Operating Income (NOI): Calculate the property’s NOI by subtracting operating expenses from gross income.

- Capitalization Rate (Cap Rate): Determine the property’s cap rate by dividing the NOI by the purchase price.

- Debt Service Coverage Ratio (DSCR): Calculate the DSCR to assess the property’s ability to cover debt payments.

- Cash-on-Cash Return: Estimate the annual cash return on your initial investment.

4. Analyze Financing Options:

- Explore Loan Options: Research different loan options, such as conventional mortgages, bridge loans, and lines of credit.

- Compare Interest Rates and Terms: Evaluate the impact of different interest rates and loan terms on your monthly payments and overall return on investment.

- Consider Loan-to-Value (LTV) Ratios: Determine an appropriate LTV ratio that balances risk and return.

5. Conduct a Sensitivity Analysis:

- Test Different Scenarios: Run “what-if” scenarios to assess how changes in key assumptions (e.g., occupancy rates, interest rates, operating expenses) could impact your investment returns.

6. Assess Exit Strategies:

- Consider Potential Exit Strategies: Determine how you plan to exit the investment (e.g., selling the property, refinancing).

- Estimate Potential Sale Price: Project the potential sale price of the property based on market trends and future income projections.

7. Seek Professional Advice:

- Consult with Experts: Consult with a real estate attorney, accountant, and financial advisor to ensure you understand the legal, tax, and financial implications of the investment. Most importantly, consult with a commercial property advisor like me who can assist you on building a comprehensive strategy for your portfolio commercial real estate investments.

Are You Accepting New Customers?

Are You Accepting New Customers?